If you recall, Hector’s bakery is located in the sunny state of California. California has one of the highest state income tax rates in the country. There are nine tax rates in California , starting at 1% and going up to 12.3%. Similar to calculating federal income taxes, taxpayers have to make adjustments to their gross income to get to their adjusted gross income. Adjustments are made by taking certain tax deductions and credits into consideration.

New changes to payroll taxes in 2020 to 2021

Similarly, the IRS Form W-2 is entitled Wage and Tax Statement. You can earn our Payroll Accounting Certificate of Achievement when you join PRO Plus. To help you master this topic and earn your certificate, you will also receive lifetime access to our premium payroll accounting materials. These include our flashcards, cheat sheet, quick tests, quick test with coaching, and more. As an employer, you withhold income tax on behalf of your employees and then remit those taxes quarterly to federal, state, and local tax incremental cost authorities. Calculating your payroll taxes is the hard part—actually making the payments is easy.

How to calculate FICA payroll tax

Businesses should stay up to date on their payroll accounting, both for their financial knowledge and to stay compliant with government regulations. If your business is ever audited, you need records of your taxes and employee compensation. One way to record payroll is to use a series of journal entries. Instead of time-consuming manual payroll processes, some organizations opt for payroll software. Modern payroll services provide companies and employees with a cloud-based portal where they can set up and view their benefits and salaries.

- Learn how your employees’ paychecks are calculated and your wage expenses are distributed as…

- (People paid every two weeks – such as every other Thursday – are said to be paid biweekly and will receive 26 paychecks during the year).

- For example, interest earned by a manufacturer on its investments is a nonoperating revenue.

- You may need to record much of this prior to calculating taxes, since it impacts the amount of wages to which taxes are applied.

Wondering how payroll accounting differs from cost accounting? Payroll taxes include Social Security which takes 6.2% of your income up to $168,600 as of 2024. Payroll taxes also pay for Medicare which takes 1.45% of your income. Internal payroll systems help companies keep confidential financial information private as well.

Usually the pay for the hours worked in excess of 40 hours per week. Federal laws require payment for these hours for employees who are not able to control their hours. For example, a company is required to pay a production worker or office clerk for hours in excess of 40 per week, even if they are salaried.

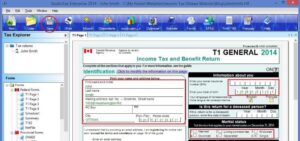

Evaluates Company Expenses

People paid semimonthly will receive 24 paychecks during a year. (People paid every two weeks – such as every other Thursday – are said to be paid biweekly and will receive 26 paychecks during the year). If the net amount is a negative amount, it is referred to as a net loss. Understanding these points will be helpful in calculating a salaried employee’s hourly rate of pay and overtime 1040 form schedule c irs form 1040 schedule c 2019 instructions printable pay earned by salaried employees. In this section of payroll accounting we focus on the gross amounts earned by the employees of a company. Independent contractors are often referred to as non-employees.

For instance, a small business with one or two employees may not offer 401(k) matching or even health insurance. By contrast, some employers may have additional accounts to add, like a fitness credit or education reimbursement. Now that you know what payroll accounting is and why it matters, you may wonder how to get started. The process involves determining the primary items for payroll accounting and gathering payroll-related documents. Many types of cloud-based accounting software are available for small businesses as well. The type of industry and number of employees are two factors that will dictate which is appropriate.

The complete guide to employee compensation

The control accounts are all balance sheet accounts representing liabilities for the what the cost principle is and why you need to know it amounts deducted from the payroll. One payroll tax that employees aren’t responsible for is unemployment taxes, called FUTA taxes, named after the Federal Unemployment Tax Act. Instead, employers take on the responsibility of paying FUTA taxes, which help unemployed workers claim unemployment insurance. Typically, employers will pay both federal and state unemployment taxes, deposit the tax each quarter, and file an annual form.